- Loan Sales Automation & Network

The Loan Sales Ecosystem

The first patented, end-to-end loan sales ecosystem — connecting automation, network reach, and real-time servicing.

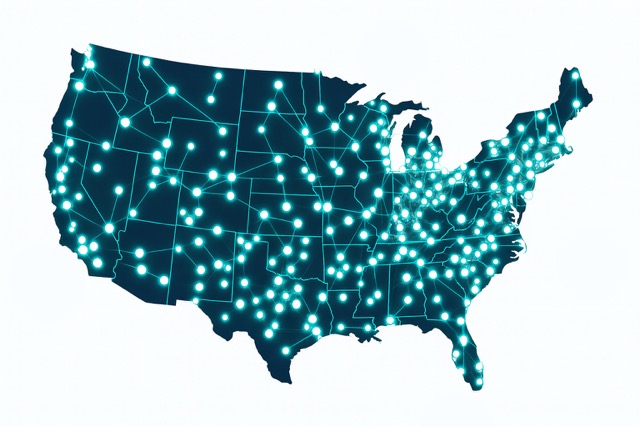

1800+ financial institutions in the Participate network

Our Partners

- About Participate

Democratize Lending

Enabling you to make larger loans, avoid concentration risk, keep your best customers and loan officers.

ROI Opportunities

Opportunity Cost – Don’t say no to new loans because of lending limit or concentration risk issues.

Time to Close – Generate more interest income by closing 2 to 4 weeks faster.

Service Fees – Charge servicing fees on loans that are participated out.

- Automation

Automation that Powers the Loan Sales Ecosystem

Improve liquidity, reduce concentration risk, keep your lenders lending, and increase fee income.

Balance Sheet Management

Centralize and manage all your loan trades—whether participations, syndications, whole loan sales, or loan assignments.

Automated Notifications

Notifications are sent for transactions, rate changes, and document updates.

Document Repository

Access, share, and update loan documents securely. Automate the document exchange process and eliminate the need for physical documentation

Integrated Agreements

Save time and reduce attorney fees with standardized agreements and electronic signatures

Real Time Balance & Transaction History

Track loan details, documents, pro rata shares, transactions, balances, and interest rate changes for any loan type

Smart Loan Optimization

Use automation to handle loans of any type, making smaller deals profitable and managing your portfolio efficiently.

- What our clients say about us

"Participate has saved us countless hours by automating what used to be a very manual process. Participants can now see what we see when it comes to transactions, balances, and interest rate changes, so everyone is always on the same page. It has eliminated the need for reconciliation with our downstream partners."

Christopher Wewers, Chief Financial Officer, Citizens Bank

Benefits

Loan Sales Automation.

When selling a new participation, just pick existing or new partners. Participate’s patented automated workflow streamlines the process with integrated NDAs and non-competes, document exchange, subscription management, and participation agreements. Our workflow shortens the time to close by weeks in most cases.

Participate is a common platform that enables originators and participants to track loan details, documents, pro rata shares, transactions, balances, and interest rate changes all in one place thereby eliminating the need to reconcile with your downstream partners. Participate also sends notifications when there is an update, automating what is typically a manual process.

Participate gives you more flexibility to make larger loans, smaller loans, avoid concentration risk, keep your best customers, and keep loan officers engaged. It is also a great tool to help manage liquidity in a changing economic environment.

Whether it’s freeing up space to make more loans, closing loans more quickly, or generating servicing fee income on sold loans, Participate’s ROI makes it a no brainer for any bank or credit union.

Looking to find the right participant partners? Participate eliminates the need for phone calls and back and forth emails. Just choose who you want to partner with and let Participate do the rest, including electronic NDA’s and non-compete agreements.

Once the agreements are in place, the document repository gives originators and participants easy access to documents and underwriting information, eliminating the need for overnight packages, couriers and drop boxes.

From origination through closing, Participate’s digital workflow includes notifications, electronic document exchange and e-signature, keeping everyone updated and taking weeks off an otherwise cumbersome process.

Once loans are closed, Participate records the transaction history for each loan, along with the pro-rata share for each party. It also notifies each participant when funds are requested or disbursed, keeping everyone on the same page in terms of dates, amounts and interest accruals.

The document repository has built in reminders for when documents need to be updated, and automatic notifications to downstream participants when new documents are added.

Custom reports are easy to build and can be created by loan type, bought vs sold, maturity date, interest rate, etc., all exportable to excel.

Work with your existing trading partners or connect with new ones via the Participate Network of high quality banks. You control who has access to each of your participations.

Whether it’s originating new loans or participating out existing ones, Participate streamlines the process so deals are faster and easier to do, allowing for more liquidity and flexibility when it comes to managing your balance sheet.

Security

Cloud Integrity

Secure Compliance

Participate delivers bank-grade security in a cloud-based environment, showcasing our SOC 2 compliance—evidence of our steadfast commitment to data protection, operational integrity, and compliance standards.

Schedule a Free Demo

Want to streamline your loan participations with automation? Discover more about Participate – book a demo today.

Office

6001 Valley Ranch DR, Little Rock, AR 72223