Addressing Credit Risk in Participations

Participations, the sale of interests in loans, inherently carry credit risk. Simply entering into a participation arrangement is not a substitute for robust credit analysis. To ensure best practices in participations, it’s crucial to employ rigorous credit processes, underwriting, and administration.

THE RISK OF LENDING: A TALE FROM BANKING HISTORY

Once, a Midwest bank made an unconventional hire – a Chief Financial Officer (CFO) with extensive public accounting experience but no background in banking. Back then, such hires were not uncommon, reflecting a different era in banking’s approach to talent acquisition.

A few months into his role, the CFO remarked, “Giving someone the bank’s money and expecting it to be fully repaid years later with interest seems quite risky.” This anecdote humorously underscores a fundamental truth in banking: while most loans are repaid, the act of lending is intrinsically risky.

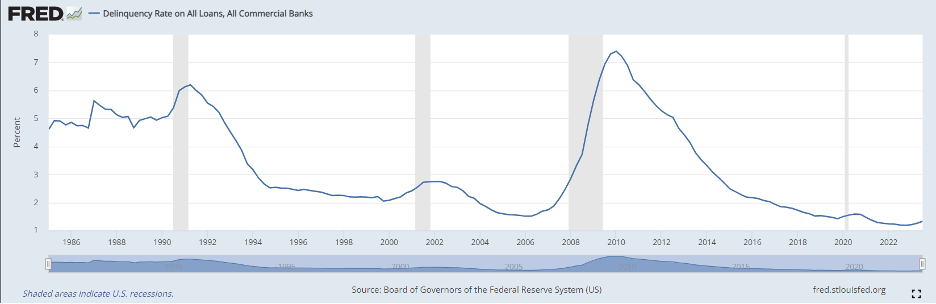

In Q3 2023, the Federal Reserve Bank of St. Louis reported that U.S. banks held only 1.33% in non-performing loans, showcasing the historical proficiency of banks in credit extension. Yet, during the 2009 Great Recession, this figure skyrocketed to 7.5%, highlighting the potential volatility in banking.

PARTICIPATIONS: NOT IMMUNE TO CREDIT RISK Participations are not exempt from credit risk. This section will explore how financial institutions can effectively address credit risk in participations.

TREATING PARTICIPATIONS WITH THE SAME SCRUTINY AS ORIGINATED LOANS The Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the National Credit Union Administration (NCUA) have all issued guidance on participations. The consensus? Treat participations with the same scrutiny as if you were the originating lender. This means not relying on another institution’s credit analysis and not using participations to offload risky loans.

The Bank of International Settlements (BIS) identifies four key areas in managing credit risk: establishing a suitable credit risk environment, maintaining a sound credit-granting process, ensuring robust credit administration, and implementing adequate controls over credit risk.

- Establishing an Appropriate Credit Risk Environment:

- Senior management should implement board-level risk policies, including strategies for participations. These policies should reflect the bank’s risk tolerance and expected profitability.

- Operating under a Sound Credit-Granting Process:

- Credit granting should be robust and include comprehensive due diligence. This applies equally to loans originated and participations purchased.

- Maintaining an Appropriate Credit Administration:

- Lenders should apply their internal risk rating systems to both loans and participations, regularly monitoring the credit quality of their portfolio.

- Ensuring Adequate Controls over Credit Risk:

- An independent, ongoing assessment of the credit risk of participations is crucial. Early intervention strategies should be in place for managing any arising credit issues.

CONCLUSION: Participate offers a patented end-to-end platform to address risk and ensure compliance within your participation portfolio. Contact us at Sales@ParticipateLoan.com or call 501.246.5148 for more information on how we can assist in managing your credit risk effectively.