CMaaS

Capital Markets

as a Service

Selling Participations & Syndications can help you:

Keep borrowers as their needs grow

Win larger relationships

Manage concentration risk

Generate fee income

CMaaS Benefits

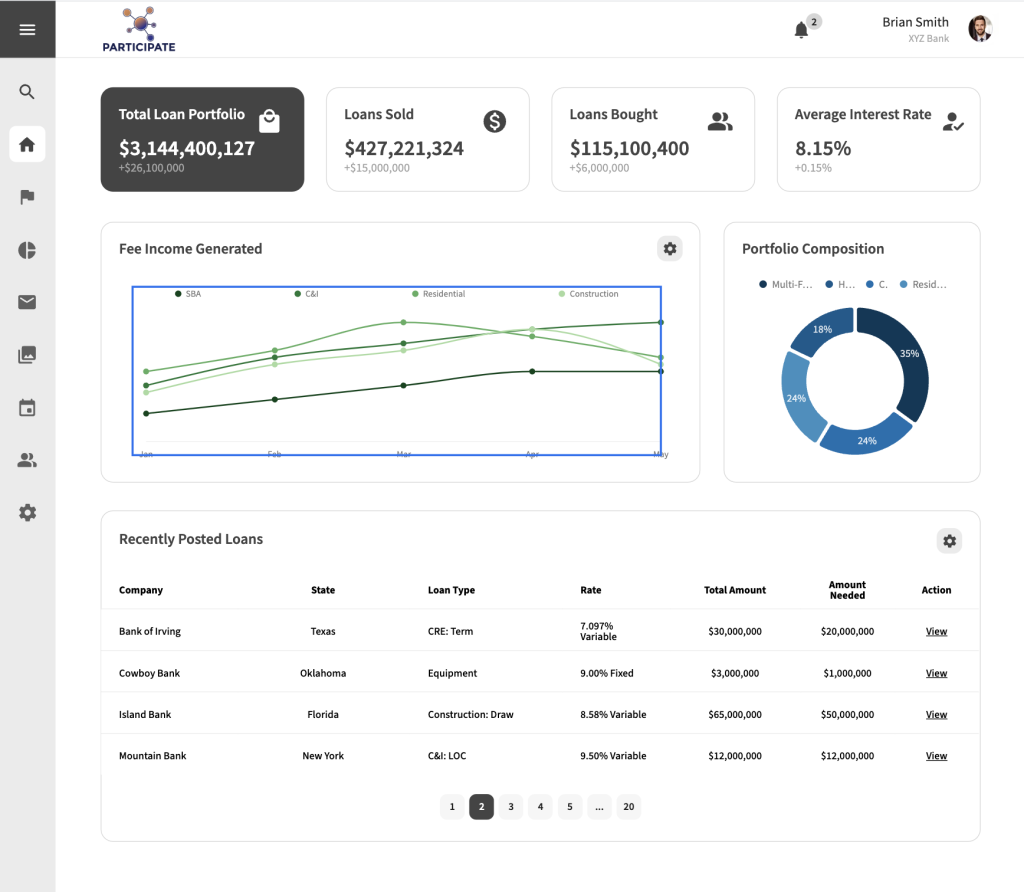

Participate makes it easy to post and sell new participations

CMaaS gives financial institutions a faster, easier way to manage liquidity, reduce concentration risk, and grow borrower relationships—without integrations or long-term commitments.

01

Upload data & docs and go live the same day.

02

Start immediately; connect to your core/LOS later if needed.

03

Centralize documents, data, and messaging for every invited buyer.

04

Transparent pricing — pay only when you post.

05

Use CMaaS only when you need it—no minimums.

06

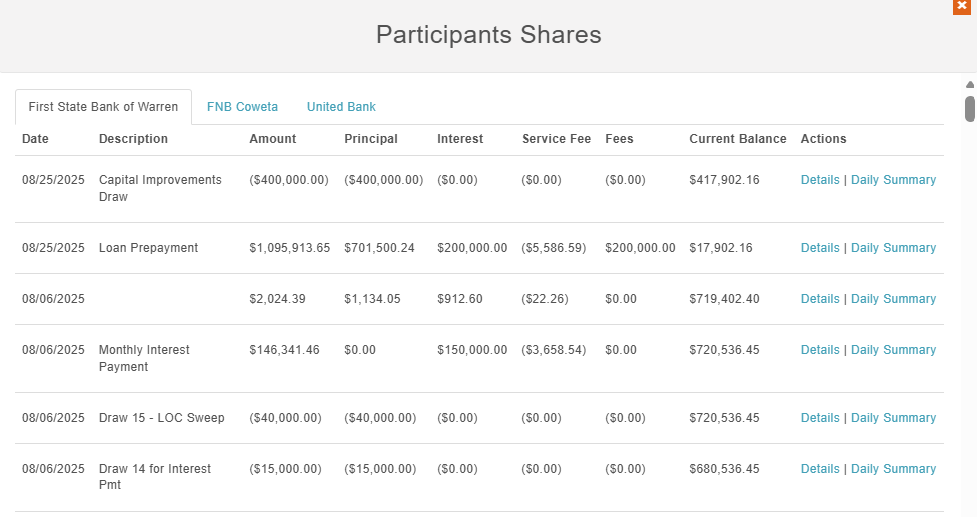

Maintain balances and notices post-close; upgrade later for automation.

How CMaaS Works

A lightweight way to run a professional loan sale—fast, secure, and on your terms.

How it works

-

Upload deal data & docs — start fast, no integration required

-

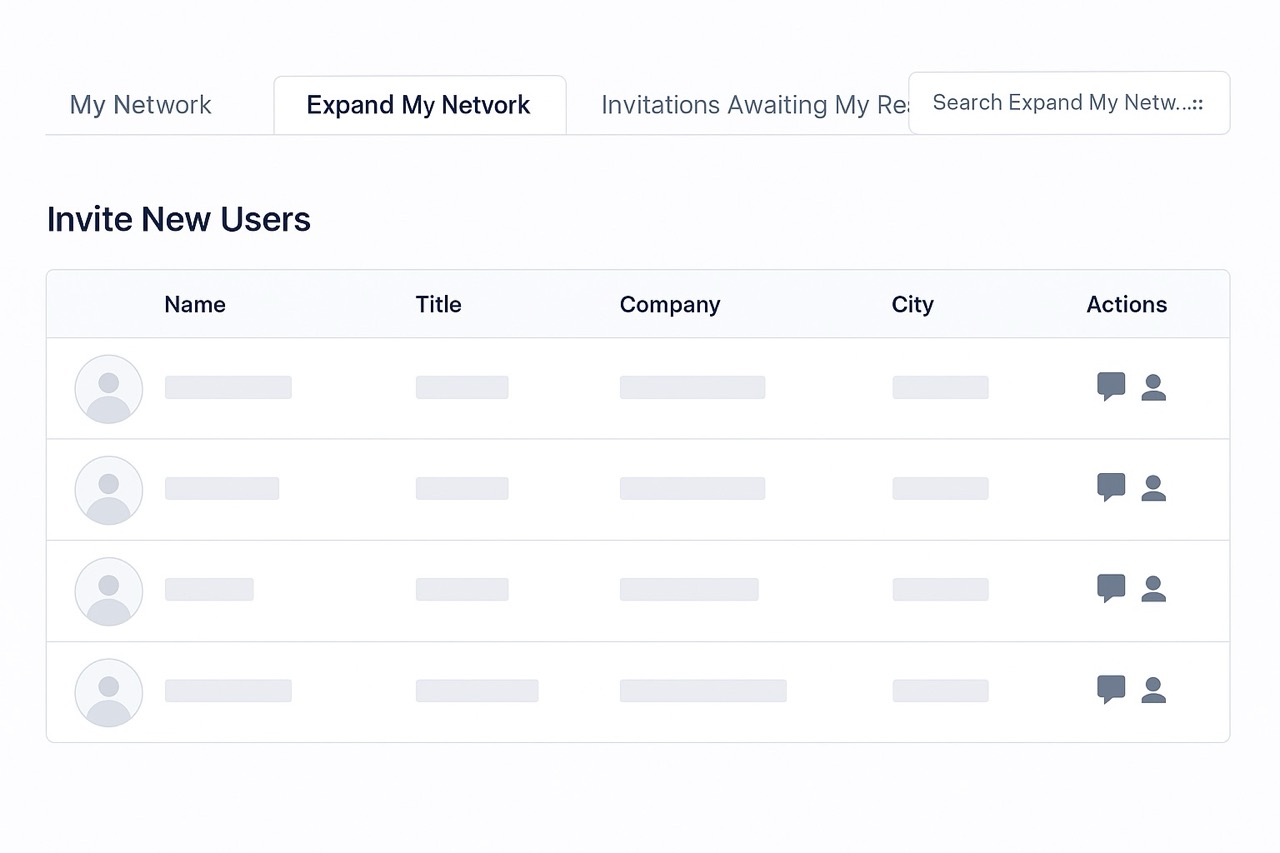

Choose your audience — your lenders or our 600+ network.

-

Built-in NDAs and encrypted data & docs

-

Capture buyer interest & close

-

Optional post-sale servicing — keep everyone in balance.

For Sellers (Originators)

Grow with borrowers, do more loans and gain more deposit opportunities.

-

Expand your network through Participate

-

Share privately with your clubs or to 600+ institutions

-

Securely add loan details + docs on deals for sale

-

Flat fee per post; no integration required

For Credit & Risk Teams

Tackle liquidity and concentration risk with a consistent, auditable process.

-

Standardized materials and version control in one place

-

Visibility across invites, NDAs, and indications

-

Optional post-sale servicing to keep balances aligned (available a la carte)

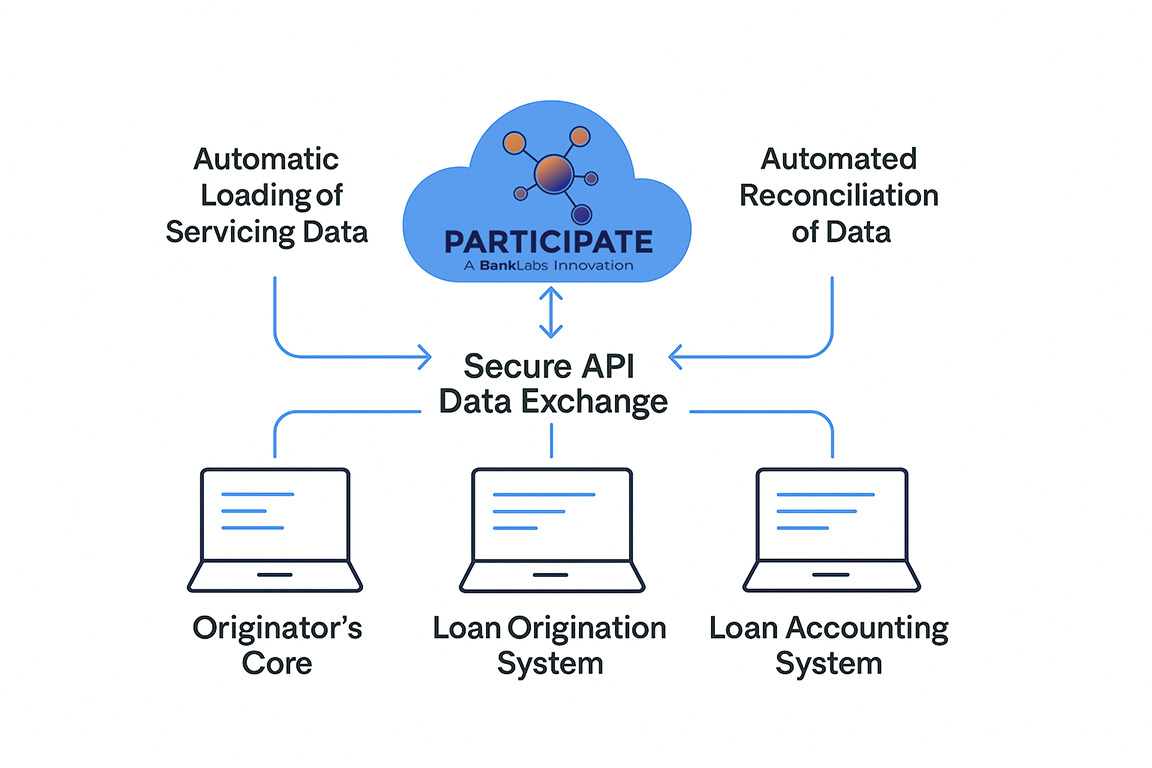

Path to Full Automation

As volume grows, upgrade to the full Participate platform for end-to-end automation.

-

Core/LOS integrations; real-time balances and notices

-

Shared balances across participants; automated reporting

-

Scale loan sales without adding ops staff

Pricing

Simple pricing for faster loan sales

Start with CMaaS for deal-by-deal posts; upgrade to the Participate platform when you want full automation.

CMaaS

-

Publish your loan sale

-

Share with clubs or 600+ institutions

-

Built-in NDAs & secure room

-

Indications tracking

-

Optional e-signature agreement

-

Optional post-sale servicing

Available "a la carte"

Flexible pricing

Participate Platform (Full Automation)

-

Programmatic loan sales at scale

-

Core/LOS integrations

-

Real-time balances & automated notices

-

Shared balances across participants

-

Advanced reporting & audit trail

-

Dedicated onboarding & success

-

Centralized buyer management

-

Advanced reporting & analytics

-

Real-time loan performance visibility

-

Audit-ready compliance & controls

Talk to Sales

Schedule a Free Demo

Want to streamline your loan participations with automation? Discover more about Participate – book a demo today.

Office

6001 Valley Ranch DR, Little Rock, AR 72223

Contact

Demo Request

FAQ

Frequently Asked Questions

Any type/size.

No. You can start instantly; publish in minutes.

You can go live in just one day — no integration required.

Only the lenders you invite, or optionally, you can publish to the broader network of 600+ financial institutions.

Yes, optional. (Full Participate platform provides automated servicing, shared balances, and notifications.)