Commercial Loan Automation: How Banks Streamline Lending and Reduce Operational Risk

Discover how commercial loan automation reduces operational risk, accelerates approvals, and modernizes loan operations across financial institutions.

Introduction

Commercial lending is the engine of most financial institutions — but it’s also one of the hardest areas to scale. Complex documentation, exception handling, covenant tracking, and manual servicing steps create friction throughout the lending lifecycle. Even banks with strong LOS tools still struggle with bottlenecks that slow down loan execution.

That’s why commercial loan automation has become a top priority for institutions looking to modernize their operations. Automation doesn’t just reduce manual work — it creates consistency, improves accuracy, and frees up staff capacity so banks can grow without adding headcount.

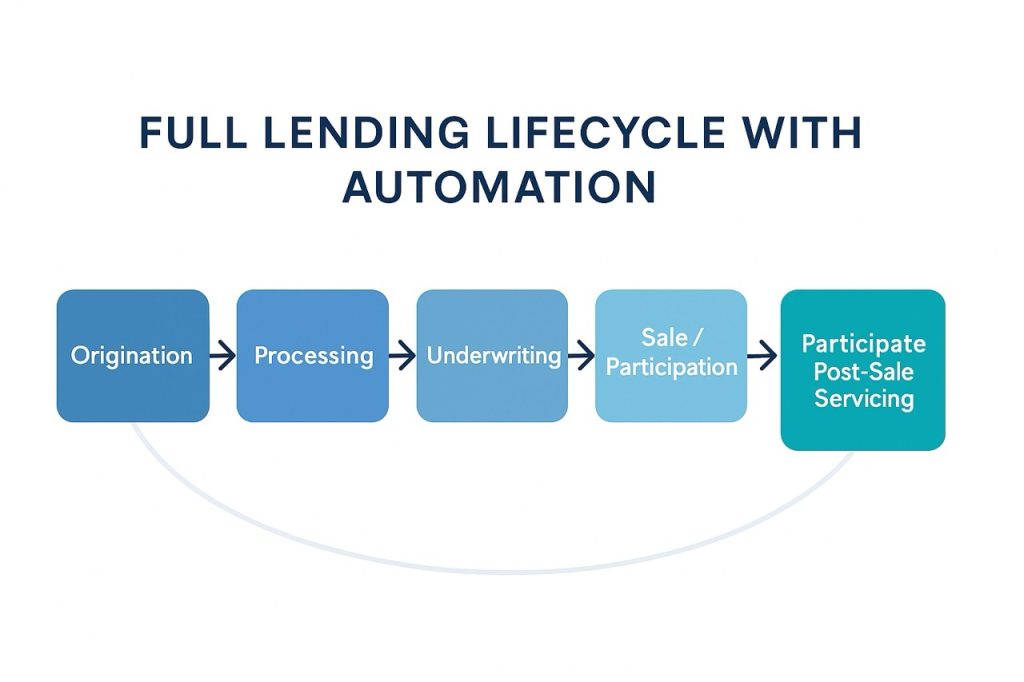

But here’s the surprising part: while most banks focus on automating origination, underwriting, and servicing tasks, the post-sale side of commercial lending remains almost entirely manual. Participations, syndications, and sold-loan servicing introduce operational risk that automation can finally eliminate.

This article breaks down what commercial loan automation really means, why it matters, and how banks are extending automation across the full lifecycle — including the post-sale phase.

Key Takeaways

- Commercial loan automation improves accuracy, reduces risk, and accelerates lending workflows across underwriting, documentation, and servicing.

- Most banks automate origination, but not post-sale servicing, where participations and syndications create major operational burden.

- Automation centralizes complex processes, making it easier for teams to collaborate and respond to exceptions.

- Banks that extend automation past origination see significant efficiency gains and stronger balance sheet management.

- Participate fills the missing piece by automating post-sale servicing for participations, syndications, and sold commercial loans.

👉 Want to automate the most complex part of commercial lending?

See how Participate streamlines post-sale servicing for participations and syndications.

What Is Commercial Loan Automation?

Commercial loan automation refers to technology that reduces manual work across the commercial lending process. It applies rules-based workflows, task routing, data validation, and automated documentation to streamline how loans move from application to servicing.

Automation replaces inconsistent, manual steps with standardized digital processes that ensure accuracy and compliance.

Common areas automated include:

- Application intake

- Document collection

- Underwriting workflows

- Spreading and financial analysis

- Approval routing

- Tickler and covenant management

- Servicing setup

- Ongoing borrower monitoring

Expert Tip:

Banks using workflow-driven automation often reduce commercial loan cycle time by 20–50% without sacrificing credit quality.

The Limits of Traditional Commercial Loan Automation

Most automation tools stop where the borrower-facing process stops.

They help with:

- Document workflow

- Credit writeups

- Approval queues

- Boarding

- Ticklers

But when a commercial loan (or part of a loan) is sold, the automation ends — and manual work takes over.

This creates a major operational blind spot.

Why the Post-Sale Stage Is Still Manual (and Risky)

Commercial loan participations and syndications require:

- Splitting principal & interest

- Handling daily rate changes

- Sending participant notifications

- Managing shared balances

- Shuffling documents back and forth

- Month-end reconciliations

- Audit trails

Most banks still do this in:

- Excel

- Shared folders

- Manual reports

- Phone calls when numbers don’t match

For billion-dollar institutions, this becomes a daily operational burden.

Did you know?

Some banks spend 5–10 hours per loan per month managing participation servicing manually.

How Automation Transforms Commercial Loan Operations

Automation strengthens commercial lending workflows in several key areas.

Streamlining Documentation and Underwriting

Commercial loans require:

- Multi-entity financials

- Projections

- Covenants

- Compliance documentation

- Complex structures

Workflow automation:

- Automatically routes docs for validation

- Ensures underwriting consistency

- Flags missing information

- Reduces exception rates

Improving Servicing Accuracy

Automation ensures:

- Correct boarding to the core

- Proper escrow handling

- Loan term accuracy

- Rate and fee schedules updated correctly

- Ticklers applied across borrowers and guarantors

This reduces downstream corrections that drain operational capacity.

Strengthening Risk and Compliance

Commercial lending involves deeper regulatory scrutiny. Automation helps banks maintain:

- Full audit trails

- Consistent approval practices

- Exception documentation

- Balance and exposure monitoring

This becomes essential as commercial portfolios grow.

But the Biggest Missing Piece: Post-Sale Loan Automation

Commercial loans are frequently sold or participated out due to:

- Loan growth

- Concentration risk

- Liquidity needs

- Relationship expansion

- Capital optimization

Yet the post-sale operational work remains one of the most manual processes in the bank.

That’s where Participate comes in.

How Participate Automates Post-Sale Commercial Loan Servicing

Participate extends commercial loan automation into the post-sale phase — the part banks haven’t been able to automate until now.

Participate automates:

- Principal and interest splits

- Participant notifications

- Rate adjustments

- Payment reporting

- Document sharing

- Shared transaction ledgers

- Reconciliation

- Audit trails

It integrates with LOS and core systems, enabling true end-to-end commercial lending automation.

Benefits for Commercial Banking Teams

1. Faster execution of participations and syndications

Deals can be sold in minutes, not weeks.

2. Reduced operational burden

Teams eliminate manual spreadsheets and reconciliations.

3. More accurate servicing

Real-time shared balances prevent out-of-balance scenarios.

4. Better liquidity management

Selling commercial loans becomes frictionless.

5. Stronger compliance

Every change is logged, tracked, and auditable.

6. Additional revenue streams

Servicing fees (often 25 bps on commercial credits) become a reliable income source.

Connecting LOS Automation With Post-Sale Automation

Banks build a complete automation loop by connecting:

- Origination automation (LOS workflows)

- Underwriting automation

- Servicing setup automation

- Loan sale automation

- Post-sale servicing automation (Participate)

This creates a scalable, repeatable system — from origination to liquidity.

FAQ Section

1. Does commercial loan automation replace underwriting judgment?

No. Automation handles the workflow; lenders and credit officers handle the analysis.

2. Can automation help with complex loan structures?

Yes. Workflow rules adapt to collateral types, borrower entities, guarantors, and covenants.

3. Do we need more staff to implement automation?

No — banks typically save staff hours and redeploy capacity.

4. Does Participate replace our LOS?

No. Participate enhances your LOS by automating the post-sale lifecycle.

5. Can automation reduce participation servicing errors?

Yes — Participate virtually eliminates out-of-balance issues through a shared ledger.

Conclusion

Commercial loan automation is no longer limited to underwriting workflows or documentation tools. Modern banks are extending automation across the full lifecycle — including the post-sale process that has historically relied on manual spreadsheets and reconciliation.

By automating post-sale servicing through Participate, financial institutions improve accuracy, reduce operational burden, and unlock liquidity faster. It’s the missing link in a fully automated commercial lending operation.

Final CTA

Ready to automate commercial loan servicing after the sale?

See how Participate transforms post-sale operations for participations and syndications.