Loan Portfolio Analysis: The Key to Smarter, Stronger Banking

In today’s fast-changing financial landscape, bankers are under constant pressure to balance growth with risk. You’re expected to increase profitability, maintain liquidity, and meet compliance—all while managing increasingly complex portfolios. That’s where loan portfolio analysis comes in.

Loan portfolio analysis isn’t just about reviewing loan performance; it’s about uncovering insights that shape smarter lending strategies. With the right data, tools, and automation, financial institutions can spot risks early, optimize returns, and make confident decisions that align with regulatory standards and community goals.

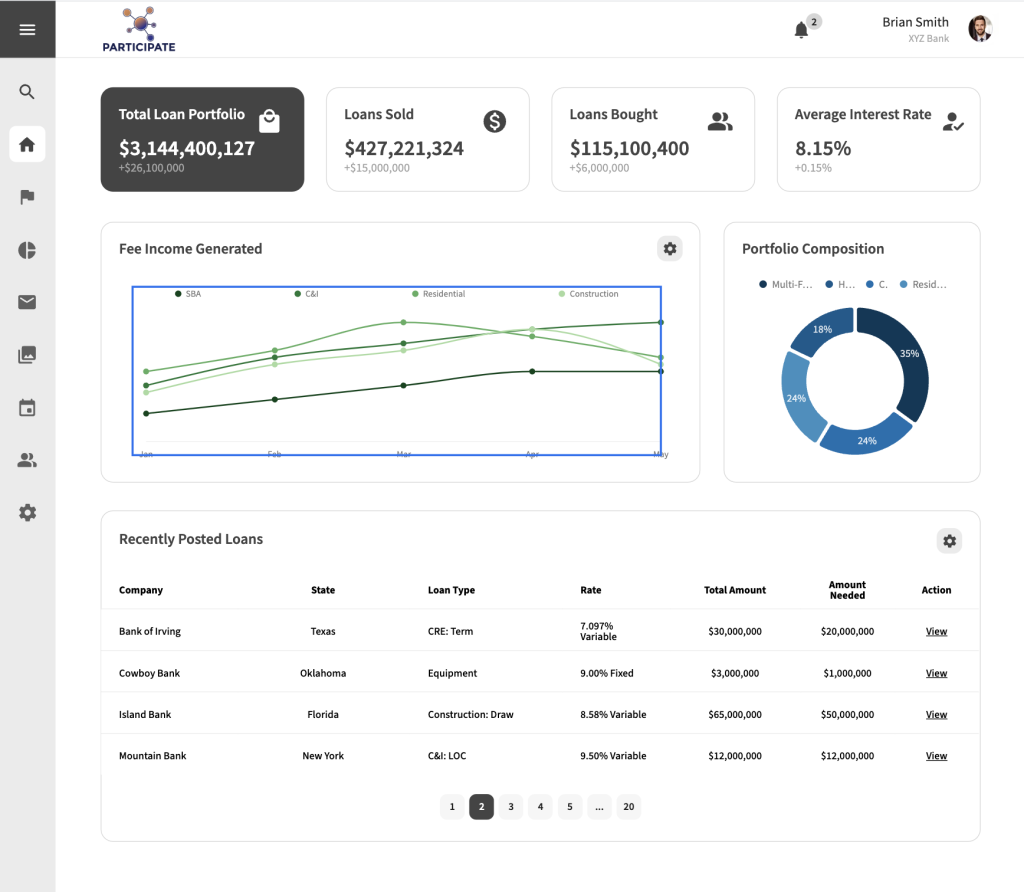

Participate helps banks and credit unions transform this process—automating loan data, providing real-time insights, and creating a shared system of truth across departments and institutions.

Key Takeaways

- Loan portfolio analysis helps identify risks and opportunities before they impact profitability or compliance.

- Automation transforms portfolio management—reducing manual work and providing real-time transparency.

- Diversification is essential for managing concentration risk by borrower, loan type, or geography.

- Integrated platforms like Participate allow banks to buy, sell, and monitor loans seamlessly while maintaining data accuracy.

- Actionable analytics turn raw data into strategic advantage—driving balance sheet optimization and growth.

Ready to modernize your loan portfolio management?

Request a Participate demo to see how automation helps you analyze, optimize, and scale your lending operation—without adding staff.

Why Loan Portfolio Analysis Matters More Than Ever

The economic landscape of 2025 is defined by volatility. Interest rate hikes, liquidity constraints, and evolving regulatory demands have made loan portfolio visibility a must-have for banks.

Without robust portfolio analysis, financial institutions risk:

- Overexposure to specific industries or regions

- Reduced liquidity and profitability

- Non-compliance with lending limits or CRA standards

Participate’s President, Matt Johnner, summarized it best in Forbes: automation allows banks to merge balance sheets and evaluate portfolios “through a data-driven lens that simplifies complex decision-making and improves performance”.

What Loan Portfolio Analysis Includes

Effective portfolio analysis combines data aggregation, risk segmentation, and performance forecasting.

1. Loan Composition and Concentration

Analyze exposure by:

- Loan type (commercial, real estate, consumer, etc.)

- Borrower or sector concentration

- Geographic region

This helps banks manage lending limits and stay aligned with regulatory caps.

2. Credit Quality and Performance Metrics

Use delinquency ratios, nonperforming loan trends, and stress testing to assess credit health. Automation streamlines this by pulling live data from loan origination and servicing systems.

3. Yield and Profitability Tracking

Track yields versus cost of funds to understand your net interest margin (NIM) and make informed repricing or reinvestment decisions.

4. Liquidity and Capital Efficiency

Loan sales and participations improve liquidity by converting illiquid assets into cash—allowing banks to say “yes” more often to new borrowers.

How Automation Enhances Loan Portfolio Analysis

Traditional portfolio reviews rely on spreadsheets, manual data entry, and delayed reporting—introducing errors and slowing decisions. Participate changes that.

Automation Benefits:

- Real-time shared balances between originators and participants

- Integrated risk dashboards to monitor exposure across loan types

- Automated notifications for rate changes, payments, and fee disbursements

- Secure document exchange ensuring compliance and audit readiness

Banks using Participate report being able to process 10x more loans without adding staff.

💡 Expert Tip: Integrate your core or LOS (like nCino or Fiserv DNA®) with Participate to automatically feed loan data into analytics dashboards—eliminating reconciliation errors and improving decision accuracy.

Analyzing for Risk and Opportunity

A well-structured loan portfolio analysis helps bankers anticipate risk rather than react to it.

Key Risk Metrics to Track:

- Concentration ratios (e.g., CRE or Ag lending)

- Credit migration trends

- Liquidity coverage

- Loan loss reserves and CECL projections

Participate’s automated workflows give executives a single system of truth, simplifying how risk data is shared and acted upon across departments.

Turning Insights Into Action

Once your data is structured and analyzed, the next step is execution.

Automation enables dynamic loan management:

- Sell participations in overexposed sectors

- Buy participations to diversify or deploy excess liquidity

- Optimize balance sheets through real-time adjustments

As American Bank’s leadership shared, “We’re using automation to turn loan participations into a high-impact growth strategy”.

The Participate Advantage in Loan Portfolio Analysis

Participate was built to help financial institutions analyze and act—not just observe.

Here’s how:

- Patented automation for full loan lifecycle management

- Network of 1,000+ buyers for instant liquidity

- Seamless integrations with core and LOS systems

- Advanced analytics and audit-ready transparency

- Immediate ROI: The tool pays for itself

FAQ: Loan Portfolio Analysis for Bankers

1. What’s the difference between portfolio review and portfolio analysis?

Portfolio review looks backward at performance; portfolio analysis uses data to predict and shape future outcomes.

2. How often should banks perform portfolio analysis?

Quarterly is ideal for most institutions, but automated systems allow for continuous monitoring.

3. Can smaller banks afford automated analysis tools?

Yes. Platforms like Participate are SaaS-based, scaling to fit the size and complexity of each institution.

4. Does automation replace human judgment?

No—it enhances it. Automation provides accurate data so your team can focus on strategy, not spreadsheets.

5. What about regulatory compliance?

Participate ensures FDIC and OCC alignment by standardizing documentation and audit trails.

Conclusion: From Data to Decision—Confidently

Loan portfolio analysis is the cornerstone of modern banking strategy. With automation and real-time visibility, you gain the agility to manage risk, liquidity, and profitability—all in one place.

Participate empowers banks to keep lending, reduce exposure, and unlock new income streams—all while strengthening the communities they serve.

📈 Start optimizing your loan portfolio today.

Visit ParticipateLoan.com or email Sales@ParticipateLoan.com to schedule a demo.